One of the most disappointing things I face as a college professor is the lack of understanding most students have regarding capitalism. The simple fact is, despite its importance to our daily lives, relatively few people have a strong grasp of what causes economic growth and why markets are so central to continuously rising standards of living.

In my teaching, I have encountered several myths or misperceptions about capitalism from students as well as individuals outside the classroom. Dispelling these myths has become a focus of much of my teaching.

Myth #1: Capitalism Was “Created”

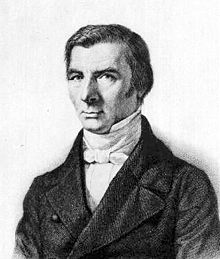

One of the most pervasive misunderstandings about capitalism is the idea that it was created by someone. Some of this can be attributed to the language used to describe Adam Smith’s role in explaining the market process. The common reference to Smith as “the father of modern economics” can lead people to assume that he in some way created the market system. It is also not unreasonable to conclude that, since socialism is generally reliant on planning, many would assume that capitalism is as well.

Markets arise out of our human qualities.

However, as Friedrich Hayek explained, the market system is not really “created” as much as it is a system that evolves out of human interaction and discovery. Similar to language, the market economy was not created by a single individual or group but evolved over a long period based on the interactions of many people. The rules and institutions which support the market economy arose from these interactions.This notion of a spontaneous order emerging out of the individual actions of millions of people, and the discovery of rules and institutions that will facilitate the continual progress of this order, may be the most important aspect of capitalism. It succeeds because it arises out of humanity itself.

Unlike socialism, which attempts to impose rules and institutions regardless of their conformity to human nature or desires, markets arise out of our human qualities. And the rules and institutions that facilitate the ability of markets to perform are discovered as we discover ourselves and in the way we interact with one another.

Myth #2: Capitalism Creates Poverty

This may be the most pernicious of all the misunderstandings I encounter regarding markets. The idea that absent market capitalism would create greater shared wealth within society continues to permeate the thinking of a great deal of people. This is despite mounting evidence that, as markets are used by more and more countries, global poverty is steadily decreasing.

All developed countries have market-based economies.

Importantly, the evidence is clear that this decline in poverty has happened as countries have come to embrace market capitalism as the way forward – especially China and India. As other countries see the success of these two previously very poor countries and begin following their lead, we can expect to see poverty in the rest of the developing world significantly reduced as well.In the Wealth of Nations, Adam Smith explained how markets, by continuously expanding the range of goods and services to an ever-increasing number of people, would produce what he called “universal opulence.” However, since Karl Marx & Friedrich Engels first launched their frontal assault on capitalism, many intellectuals, entertainers, and even politicians have embraced the idea that capitalism causes poverty, or at least prevents people from escaping it, and more disturbingly, that socialism leads to greater prosperity for the masses.

It’s not surprising, then, that these ideas filter down to the public-at-large. But this idea that capitalism leads to poverty for the masses while socialism leads to their prosperity is exactly opposite to all the evidence we have.

All developed countries have market-based economies. Those developing countries seeing the greatest growth have adopted market principles. Contrast this with countries that have fully adopted socialism, such as Venezuela or North Korea. It is troubling that incoming students do not understand this.

Myth #3: Capitalism Is about Capital

The underlying foundation of capitalism is human freedom.

The term “capitalism” was coined by Marx as a pejorative towards market-based economies. The term stuck and has led to some confusion about why markets actually work. As economic historian Deidre McCloskey has noted, people at all times have attempted to amass capital (land, resources, and money). But those collective attempts didn’t lead to the type of society-wide economic growth we have seen since 1800.The underlying foundation of capitalism is human freedom. As Adam Smith recognized, when individuals are permitted to pursue their self-interest through markets, they are amazingly good at finding ways of bettering not only themselves but society as well.

Equally important, as economist Joseph Schumpeter explained, out of this freedom arises a continuous process of improvement – what he called “creative destruction.” It is this constant innovation – discovering and bringing to market new products and services, finding ways of improving existing products and services, and finding more efficient ways to create these products and services – that truly drives economic growth and increases standards of living.

The fact is, while the accumulation of capital is a feature of a market economy, it’s certainly not exclusive to it. It is individual freedom and the innovation that arises from it that drives the engine of capitalism.

Myth #4: Capitalism Creates “Winners” and “Losers”

While it is true that some individuals and firms succeed while others do not in capitalism, this also is hardly an exclusive feature of markets. All economic systems have some individuals who succeed and others who fail in one form or another.

Over the long run, society in its entirety benefits as a result of markets.

However, capitalism is different in this regard in two important ways. First, capitalism increases the number of “winners.” Unlike other systems, capitalism reduces the barriers to entry into market activity for larger numbers of individuals. The resulting competition provides greater opportunities for success (both great and small) than in any other system.Second, over the long run, society in its entirety benefits as a result of markets. This is because markets, as mentioned above, bring more goods and services within reach of more people than any other system.

Markets also produce products and services that improve our lives in ways that our ancestors could never have dreamed. Just consider all the things that exist today, that didn’t a mere thirty years ago. The simple fact is that today even the poorest modern Americans have more goods and services at their disposal than kings and queens did just two hundred years ago.

So, although individual firms may fail, and individual people may not gain great wealth, the fact is that, over the long-run, we all win by enjoying better living standards than previous generations.

We Need Better Education

If the United States is going to continue to see its economy grow and the living standards of its citizens improve, it is important that students are taught the basics of the economic system that has allowed them to experience Adam Smith’s “universal opulence.” Without this basic knowledge, they’re easily led to believe the myths I’ve mentioned and to vote for politicians and policies that will ultimately undermine the very system that has made their lives significantly better than their ancestors, as well as better than most of their contemporaries across the globe.

James Davenport

James Davenport is an award-winning professor of political science at Rose State College and has also taught economics at the University of Central Oklahoma. You can find him online here.

Republish from Fee.org

Recent Comments